net investment income tax repeal 2021

You are charged 38 of the lesser of net investment. For income tax purposes T can reduce his taxable income by the FEIE amount for tax year 2021 the.

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

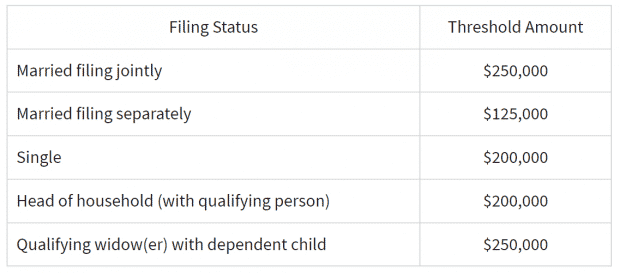

The net investment income tax will apply to a taxpayer only if their.

. April 28 2021 The 38 Net Investment Income Tax. For estates and trusts the 2021 threshold is. Individuals estates and trusts that paid significant amounts of the 38 net investment income tax or the 09 additional Medicare tax in 2016 or later years.

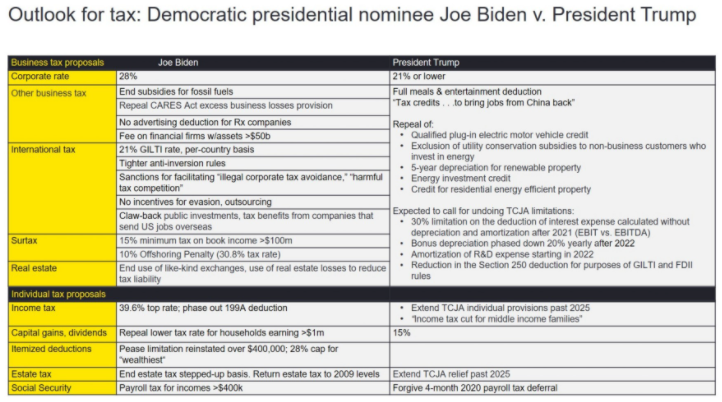

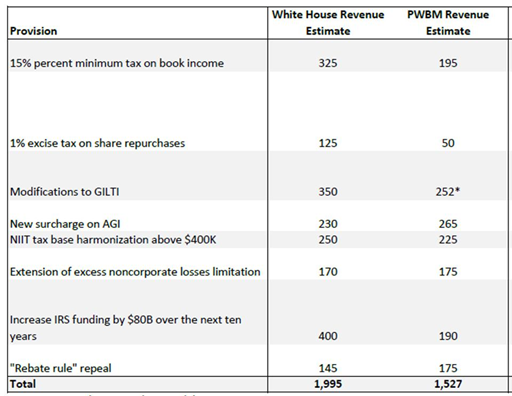

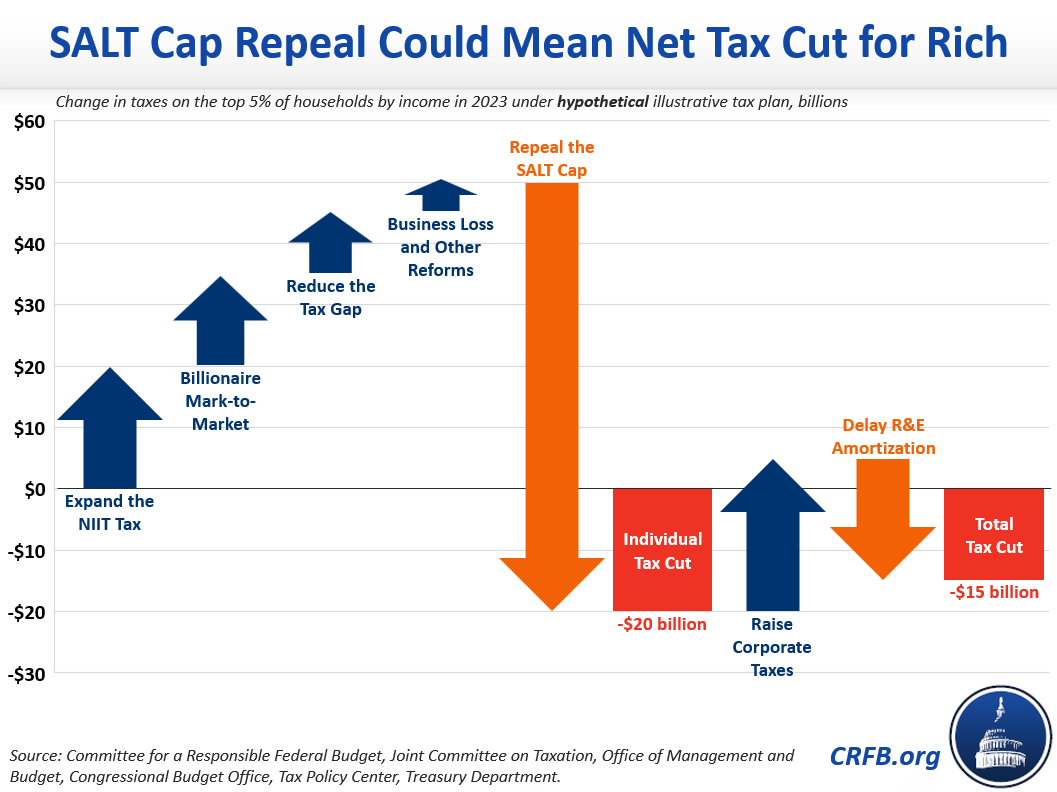

An increase in the top individual tax rate from 37 to 396 for tax years ending after Dec. 1 It applies to individuals families estates and trusts. On January 4th the United States Senate voted 51-48 on a motion to move forward with a budget.

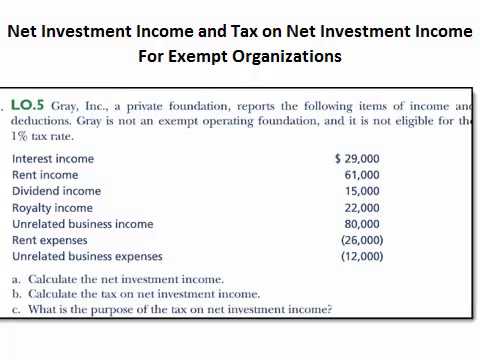

Internal Revenue Service Code Section 1411 imposes a 38 tax on a taxpayers net investment income. June 17 2021 by Ed Zollars CPA. How Do I Report the NIIT.

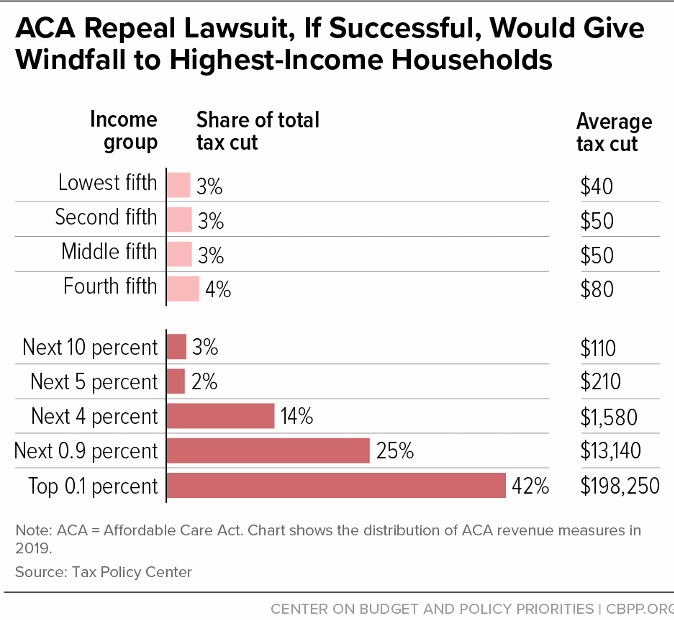

All About the Net Investment Income Tax. If the Supreme Court were to repeal Obamacare in part or whole it is possible that 38 tax on Net Investment Income and the 09 Additional Medicare tax under Obamacare. 3 This includes a 25 long-term capital gains tax rate a 38 net investment income tax and a 3 surtax on individuals with modified adjusted gross income exceeding 5.

The IRS gives you a pass. Obamacare And Net Investment Income Tax Repeal. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year.

There is a flat surtax of 38 on net investment income for married couples who earn more than 250000 of adjusted gross income AGI. Supreme Court Rules Plaintiffs Did Not Have Standing to Challenge Affordable Care Act Net Investment Income Tax Remains in Force. Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income.

Assume his net earnings from self-employment are US208700. The Net Investment Income Tax NIIT or Medicare Tax is a 38 Surtax imposed by Section 1411 of the Internal Revenue Code on investment income. January 5 2017.

For single filers the threshold is just. Calculating NIIT is not just as simple as multiplying your net investment earnings by 38. 2021 Capital Gains Tax Rates and.

The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers. Expansion of the net investment income tax NIIT to cover net investment. There is not going to be a net investment income tax repeal in 2021 but if the ACA is repealed in the future it is highly likely the NIIT would also be repealed.

For 2021 the government will raise 275 billion in revenue generated from net investment income tax alone according an analysis by the Congressional Research Service. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts.

:max_bytes(150000):strip_icc()/GettyImages-1160172463-9d00a407bf63428a9bb030b683d1c863.jpg)

What Is The Net Investment Income Tax

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

A Guide To The Net Investment Income Tax Niit Smartasset

Net Investment Income Tax Still A Burden After Tcja

Tax Reform News Alert Biden Administration Proposes To Retroactively Raise Capital Gains Taxes Legal 1031

Post 2020 Tax Policy Possibilities Lexology

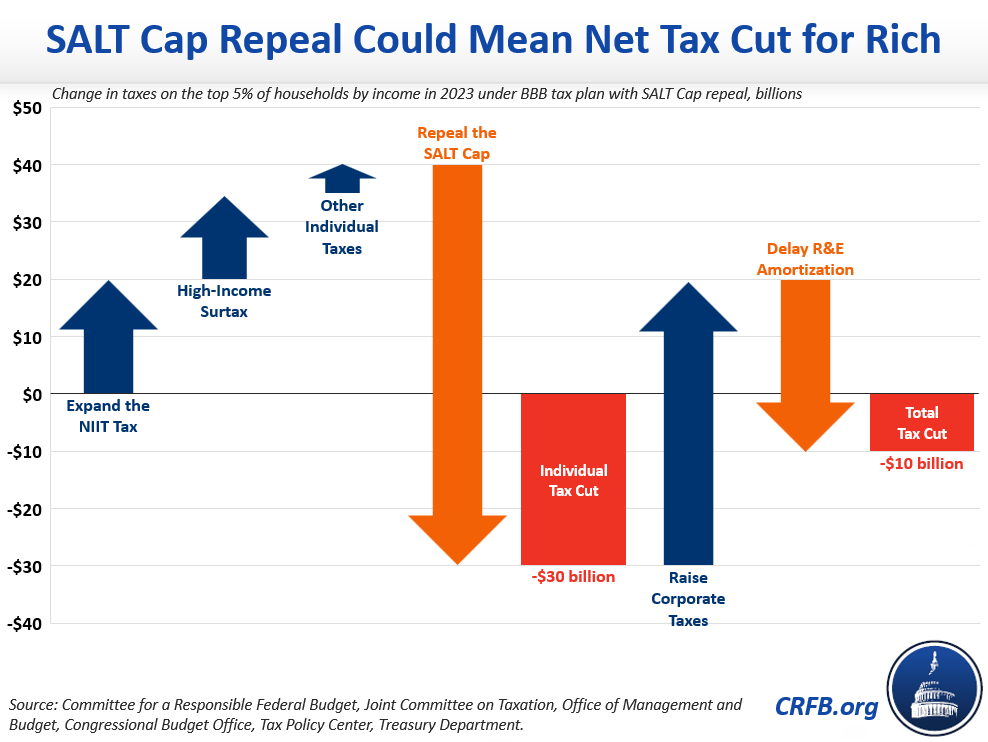

Reconciliation May Deliver A Tax Cut To The Rich Committee For A Responsible Federal Budget

Ending Special Tax Treatment For The Very Wealthy Center For American Progress

Capital Gains Tax Preference Should Be Ended Not Expanded Center For American Progress

2021 State Income Tax Cuts States Respond To Strong Fiscal Health

Forbes Highlights Hit To Pass Throughs The S Corporation Association

Could Reconciliation Deliver A Tax Cut To The Rich Committee For A Responsible Federal Budget

Expanding The Net Investment Tax Mostly Would Target Households Making 1 Million Or More

An Overview Of Capital Gains Taxes Tax Foundation

Carver Darden Carver Darden Tax Law Specialist Jay Lobrano Breaks Down The Treasury Department S General Explanations Of The Administration S Fiscal Year 2022 Revenue Proposals Click The Link Below To Read All

T22 0013 Application Of Niit To Trade Or Business Income Of Certain High Income Individuals In H R 5376 By Expanded Cash Income Level 2023 Tax Policy Center

Aca Repeal Lawsuit Would Cut Taxes For Top 0 1 Percent By An Average Of 198 000 Center On Budget And Policy Priorities

Net Investment Income Tax Niit When It Will Apply How To Avoid

Net Investment Income And Tax On Net Investment Income For Private Foundations Youtube